Contents:

You’ll get no-fee trading on stocks and ETFs as well as options and cryptocurrencies. Bolstering its reputation further is the fact that Fidelity secured the top spot in Investor’s Business Daily’s 2022 investor survey, which polled the customers who actually use their services. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

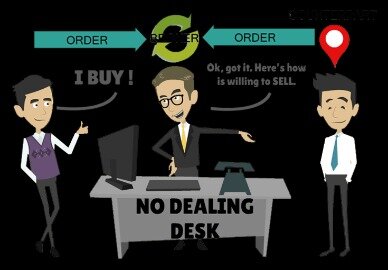

Now, you have a large number of options to trade stocks and other securities commission-free. Even so, each trading platform has different benefits and drawbacks. Low commissions starting at $02 with no added spreads, ticket charges, platform fees, or account minimums. Most brokers now offer no-commission trading on basic stock trades, but we looked for low-cost fee structures across the board.

- When you see a brokerage offering no trading or commission fee, it doesn’t mean there aren’t any fees.

- IBD Videos Get market updates, educational videos, webinars, and stock analysis.

- Steven Hatzakis is the Global Director of Research for ForexBrokers.com.

- Active traders pay close attention to market movements hoping to find opportunities to profit.

That said, investing is a very personal matter, and both companies offer investors a great product and a ton of value. I can’t imagine what it would have cost to get these types of tools 5 or 10 years ago (if they even could have been done!). But if you do like to trade individual stocks, the discount brokers are often better options as they tend to offer lower cost trades, more tools, and a better interface for trading. These plans initially helped investors avoid brokerage fees, but the rise of online discount brokers with zero fees has removed this barrier, making the direct stock purchase plan somewhat archaic. It will help you understand your total financial picture, including your net worth, asset allocation, how much you pay in fees, and where you can rebalance to get your portfolio in shape. It’s 100% online and uses bank-level security features to track your investments.

E*TRADE: Best Extensive Research Tools

These rates can vary widely from one broker to another, and sometimes go all the way to 12.00% as with TD Ameritrade. When deciding where to buy stocks, you should look for low stock commissions, low inactivity and withdrawal fees, and smooth deposit and withdrawal functions. It is a reality of the market thatno reward comes without risk. You can lose money buying a bad investment, but you can also lose by buying a good investment at the wrong time.

best online brokers for beginners can avail of the benefits from Schwab’s Robo-advisor with a minimum investment of $5,000. The platform is renowned for its extensive research and assistance features. It features several best-in-class portfolio analysis tools and stock and asset screeners. All customers with Fidelity accounts have free access to the platform’s highly regarded research articles and partner content from more than 25 industry-leading websites. There were more than 3,300 brokerage firms registered with the U.S. regulatory agency FINRA as of 2021. Choosing one is not an easy task, but for practical purposes, we can cut that list down to a fairly small number of online discount brokers.

Here’s a rundown of common fees for our picks of the best brokerage accounts. An online broker is an investing tool that helps people buy and sell stocks, bonds and funds. Unlike traditional brokers, who require face-to-face interactions, online brokers provide online trading platforms to handle all transactions. They feature easy-to-use trading tools, research and analysis, and customer support.

Interactive Brokers (IBKR)

Fortunately for tastytrade users, these low commissions do not come with a platform that delivers poor options analytics, inefficient platform workflow, or slow trade execution. In fact, the tastytrade platform brings all of these elements together in a manner that is among the best of all the companies we reviewed. We chose tastytrade as the best options trading platform because of the way it optimizes tools and content to suit the needs of its options-focused client base. Moreover, tastytrade has set up its options pricing with caps that make it the lowest-cost brokerage for high-volume, high-frequency option traders. TD Ameritrade’s highly regarded thinkorswim® trading platform is powerful yet intuitive. Developing personal trading strategies is made easier with access to robust backtest tools, while the implementation of these strategies can be practiced using the platform’s very capable paper trading function.

Interactive Brokers facilitates trading and investing across asset classes in over 150 international markets. As of September 30, 2022, the platform has approximately 2.01 million customer accounts and client equity worth $287.10 billion. The platform features individual investment and professional accounts for businesses and institutional investors.

These partnerships may influence the products we review and write about , but they in no way affect our recommendation. All of our content and reviews are based on our research and honest opinion. None of our partners or advertisers have editorial input or control because our relationship with our readers always comes first. Cash accounts do not have the feature of borrowing money from the firm and can be only able to place a trade with the money that they have in their accounts. The global trading platform market is expected to reach $17.85 billion by 2023, growing at a CAGR of 13.3% from 2018 to 2023. The market is also highly regulated, with platforms having to comply with a range of rules and regulations to ensure investor protection.

Brokerage Trading Platforms Statistics, Trends And Facts 2023

A total of 135 markets in 33 countries are available for trading. Robo-advisors, on the other hand, offer a hands-off solution to investors who would rather pass off investment decisions to professional managers, a computer algorithm or a combination of both. In fact, the best robo-advisors typically offer advanced management algorithms and user-friendly interfaces, requiring little how-to knowledge.

The platform allows trading on a uniquely wide range of international stock exchanges, as well as fractional share investing. You can also set up a direct dividend reinvestment plan, ensuring immediate reinvestment of dividends earned without requiring constant monitoring of accounts. While Interactive Brokers is smaller than some industry leaders, including Charles Schwab and Fidelity Investments, its top-notch features and services make it one of the best options for a seasoned investor. On the other hand, options trading bears a fee ranging from $0.50 to $0.65 depending on the contract volume and monthly trading history. Foreign stock trades, over-the-counter trades and large-block transactions will incur charges. The Robinhood platform remains popular among retail investors, despite the GameStop controversy in early 2021.

Investopedia’s 2020 Best Online Brokers Awards – Investopedia

Investopedia’s 2020 Best Online Brokers Awards.

Posted: Tue, 26 Feb 2019 10:39:14 GMT [source]

Your trading app will send you the code by either email or text, and you then type that code to gain access to your online account. Not only does it charge no commissions on options, but it doesn’t charge any per-contract fees either. To gather this information, we relied on the company’s own websites and also considered customer testimonials published on YouTube and in the reviews sections of mobile app stores. This is the percentage of your investment that goes toward operating costs on an annual basis.

How to pick the best stock broker

Options trading entails significant risk and is not appropriate for all investors. Before trading options, please readCharacteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request. Tastytrade maintains its stance as the best broker for options because of its intuitive delivery of an industry-best mix of options-focused tools and content.

One way to do this is to see if the brokerage firm offers a “play” account, where you can open an account and make stock trades with play money while you learn how their platform operates. The minimum amount required to open an account with an online broker is typically low nowadays – usually less than $100 – and, in some cases, with as little as $1. To execute your first trades, some brokers have created fractional shares.

Online trading platforms give you access to investments like stocks, bonds, ETFs and mutual funds so you can build an investment portfolio that meets your financial goals. Trading costs definitely matter to active and high-volume traders, but many brokers offer commission-free trades of stocks and ETFs. Other factors — access to a range of investments or training tools — may be more valuable than saving a few bucks when you purchase shares. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Firstrade charges no fees for trading US-listed stocks, ETFs, or mutual funds.

5 Best Online Brokers For Stock Trading of April 2023 – FinMasters

5 Best Online Brokers For Stock Trading of April 2023.

Posted: Thu, 03 Nov 2022 16:10:39 GMT [source]

Merrill Edge® Self-Directed offers easily one of the biggest cash bonuses we’ve seen. It’s a standout brokerage with $0 online stock and ETF trades, strong research offerings, and excellent customer support. Owned by Bank of America, you can also get access to its fantastic Preferred Rewards program.

When it comes to functionality, https://trading-market.org/ibility, and flow across the mobile, desktop, and web platforms, TD Ameritrade offers an experience that is as consistent as it gets. For investors looking for individual help, Fidelity has added to its lineup with digital direct indexing accounts called Fidelity Managed FidFolios. The FidFolios use fractional shares to mimic indexes with ownership of the actual stock rather than an ETF, allowing for deeper customization. But the improvements don’t stop there, as Fidelity also upgraded its mobile experience with a redesigned app dashboard that includes streaming quotes on the home screen and further news feed customizations. When we started our 2020 online broker reviews six months ago, no one knew how the world would change.

When people talk about investing they generally mean buying assets to hold for a long period of time. The goal of investing is to gradually build wealth and reach your retirement goals. Conversely, trading involves short-term strategies that maximize returns on a short-term basis, such as daily or monthly.

- Aditya Raghunath is a financial journalist who writes about business, public equities, and personal finance.

- The Military Wallet and CardRatings may receive a commission from card issuers.

- The College Investor does not include all companies or offers available in the marketplace.

- Note that Fidelity also charges a short-term redemption fee for no-transaction-fee mutual funds in its FundsNetwork held for less than 60 days.

- If you plan to actively trade, you’ll value investing platforms that provide in-depth research, analysis and news so you can make informed decisions about when and what to buy or sell.

- I review software to find the best tools that can help your online business thrive.

Schwab offers a solid suite of tools for traders, investors, and beginners, but its notable strength is in financial planning. Clients will find useful calculators that can help them make informed long-term investing decisions. Schwab’s Choiceology podcast from Wharton professor Katy Milkman is a joy. As noted above, Schwab acquired TD Ameritrade in 2020 and is in the process of merging the two brokers.

Like mutual funds, each ETF contains a basket of stocks that adhere to particular criteria (e.g., shares of companies that are part of a stock market index like the S&P 500). Unlike mutual funds, which can have high investment minimums, investors can purchase as little as one share of an ETF at a time. Fidelity offers $0 trading commissions, a selection of more than 3,300 no-transaction-fee mutual funds and top-notch research tools and trading platform.

Many of the brokers we reviewed also gave us live demonstrations of their platforms and services, either at their New York City offices or via video conferencing methods. Live brokerage accounts were also obtained for most of the platforms we reviewed, which our team of expert writers and editors used to perform hands-on testing in order to lend their qualitative point of view. Tastytrade delivers very competitive fees for options trading, with standout features like commission caps for large lot sizes, as well as the absence of any commissions when closing positions.

Most online brokers have a secure connection nowadays and also offer a two-step secure login feature for the user to log in safely. The amount that is loaned to the investor depends on the stocks or cash they have in their account as collateral. Margin Accounts usually have interests and the person borrowing the money is required to pay the interest for the number of stocks that they have loaned from that institution. Generally, the term Trading Account is used to refer to a day trader’s account. With the help of a trading account, an investor can be able to sell/buy/hold different types of assets during a trading session. This article will speak about different trading and brokerage accounts.

If your goal is to create a diverse portfolio of individual stocks without a large upfront capital commitment, be sure the broker you choose has both of these features. Online brokers are popular due to their convenience, low costs and accessibility. With an online broker, investors can trade anytime and anywhere. Additionally, they have lower commission fees and account minimums than traditional brokers, which helps make investing accessible to a wider range of people. All of the leading online brokers today offer free stock trading and zero commissions on buying and selling many other types of assets. That makes choosing the best brokerage a matter of comparing ease of use, customer service and other features.

Betterment – Based in New York City, Betterment is the original robo-advisor and launched in 2011. Its board includes Dr. Burton Malkiel, professor of economics, emeritus and senior economist at Princeton University. He is most known for authoring the classic finance book, A Random Walk Down Wall Street, now in its 12th edition. Betterment charges just 0.25% to manage your money, with the first $15,000 free using my link.

Best Online Stock Brokers of 2023 – Buy Side from – The Wall Street Journal

Best Online Stock Brokers of 2023 – Buy Side from.

Posted: Thu, 02 Feb 2023 08:00:00 GMT [source]

Robinhood offers zero-commission trades for US-listed stocks, ETFs, options, and cryptocurrencies. While it also provides the possibility of owning fractional shares of certain companies whose stocks are considered high-priced. Along with great features such as bonuses for savings interests, credit card cashback, $0 trades, etc., Merrill Edge is considered a good choice for investors and raked as “#1 online broker for ESG research”. ‘Fidelity’ – Fidelity is an online broker known to be a value for the quality. It also has a set of amazing trading tools along with an excellent mobile application known for its exquisite user interface. In the past, the investor was able to access/handle all the trading activities physically until 1970.